AI Agent Development

Fraud Detection & Risk Analysis

Tell us about your project.

Stay one step ahead of fraudsters with AI that adapts faster than criminal tactics can evolve.

Why Work With Orases?Fraud detection & risk analysis AI agents continuously monitor transactions and user behavior, identifying suspicious patterns and potential threats in real-time. These intelligent systems learn from historical data to establish behavioral baselines, automatically flag anomalies, and prioritize risks while reducing false positives, helping security teams respond faster to genuine threats across financial, identity, and access control systems.

What This AI Agent Is

Static rules and basic filters alone aren’t enough to identify fraud in fast-moving and high-stakes environments.

A Fraud Detection & Risk Analysis AI Agent monitors transactional and behavioral data continuously, looking for subtle signals that suggest suspicious activity. It identifies unusual patterns, mismatched locations, abnormal login behavior, or signs of account takeovers, learning over time to adapt to new fraud tactics as they emerge.

The detection agent reviews a wide range of data inputs, including payment history, login frequency, device fingerprints, and geographic trends. From there, it builds a behavioral profile for each user or account, then compares new activity against that baseline.

Then, when something falls outside expected norms, it flags the incident, prioritizes it by risk level, and notifies the appropriate team for follow-up. This level of pattern recognition makes it ideal for use across financial transactions, identity systems, insurance claims, or access control environments.

The agent’s ability to analyze multiple factors in context leads to better accuracy and fewer false positives compared to traditional rule-based systems.

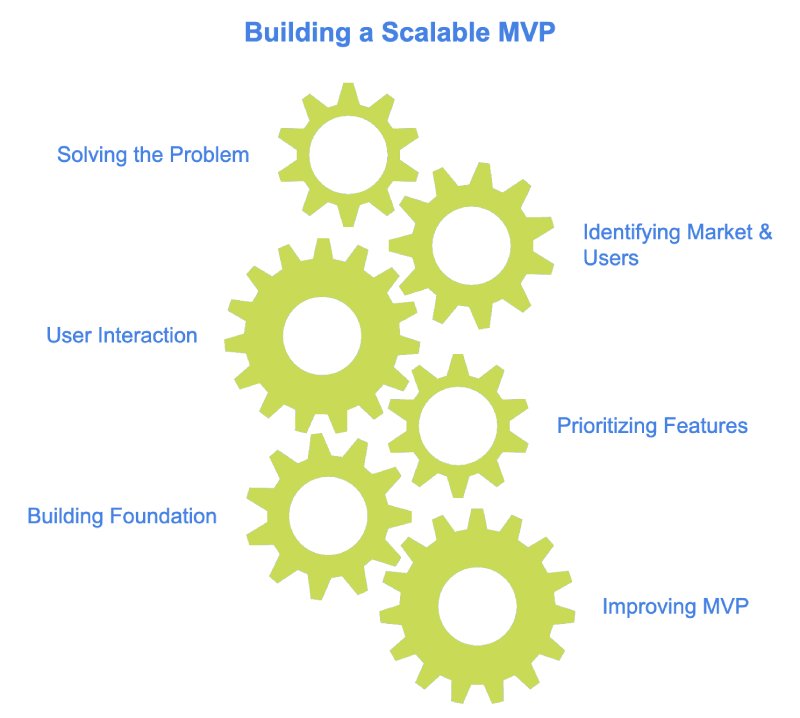

Types Of Custom AI Agents We Develop

From simple task automation to complex decision-making systems, we develop AI agents that match your specific operational needs and growth objectives.

Every business challenge requires a specific type of AI agent to deliver optimal results. We offer a complete spectrum of AI agent architectures, each designed to address distinct operational needs and objectives.

Autonomous Agents

Self-directed AI systems that independently perform complex tasks, make decisions, and adapt to changing conditions without human intervention, perfect for automated process management and system optimization.

Deliberative Agents

Strategic decision-making agents that analyze multiple factors and potential outcomes before taking action, ideal for complex business planning and resource allocation.

Goal Based Agents

Objective-driven AI systems that determine the best path to achieve specific outcomes, excellent for optimizing operations and achieving measurable business targets.

Hierarchical Agents

Multi-layered decision-making systems that break down complex tasks into manageable sub-tasks, perfect for handling intricate operational workflows.

Learning Agents

Adaptive AI systems that continuously improve performance through experience and data analysis, perfect for evolving business environments.

Logical Agents

Rule-based systems that make decisions through systematic reasoning and logic, ideal for compliance, quality control, and consistent decision-making.

Model Based Reflex Agents

Context-aware systems that combine current inputs with historical data to make informed decisions, perfect for dynamic operational environments.

Multi Agent Systems

Collaborative AI networks that work together to solve complex problems, ideal for large-scale operations requiring coordinated decision-making.

Planning Agents

Strategic AI systems that create and optimize step-by-step plans to achieve specific goals, perfect for project management and resource allocation.

Simple Reflex Agents

Efficient rule-based systems that provide immediate responses to specific inputs, ideal for basic automation and routine task management.

Utility Based Agents

Decision-making systems that evaluate options based on value and benefit, perfect for optimizing resource allocation and risk management.

Vertical AI Agents

Specialized AI systems focused on specific industry domains, delivering deep expertise and targeted solutions for sector-specific challenges.

Why It’s Useful

Fraud prevention efforts often struggle to keep up with constantly shifting techniques, and static thresholds or rigid rules can miss threats that don’t follow expected patterns. The AI agent learns what normal behavior looks like and adjusts dynamically, improving both detection and trust in the results.

Reducing false positives is a major benefit companies can enjoy. When too many legitimate actions are flagged, teams waste time reviewing harmless activity, and customers become frustrated. The agent improves that signal-to-noise ratio by understanding intent, behavior history, and contextual relevance.

Speed matters in fraud response, and catching an issue early helps prevent financial loss, protect customer accounts, and minimize the impact of a breach. The agent operates in real time, scanning activity as it happens and alerting the right teams without delay.

Integration flexibility makes this agent useful across different industries and departments. Whether reviewing internal access logs, evaluating insurance claims, or monitoring online transactions, the system adapts to the structure and priorities of each environment.

Get A Free Technical Consultation & Quote for AI Agent Development

As pioneers in conversational AI, Orases can consult on agents customized for your industry’s unique customer and employee engagement needs. Contact us today to discuss possibilities and receive a personalized quote. Our specialized solutions deliver next-gen experiences powered by humanlike, adaptive AI.

Contact Us Today

Problems It Solves

Static fraud detection rules often fall behind new techniques: fraudsters are able to adapt quickly, and rigid filters miss activity that doesn’t match predefined scenarios. The AI agent identifies behavioral changes that would otherwise go unnoticed, enabling security teams to respond more quickly to threats.

Too many false alarms drain time and resources, as traditional systems often generate noise that slows response times and lowers trust in alerts. The AI agent filters out low-risk anomalies, allowing teams to focus on real threats with greater clarity.

Delayed detection increases the risk of financial damage. When fraud is identified too late, the cost multiplies and the impact spreads, but real-time analysis shortens that window and improves containment.

Erosion of customer trust is another long-term consequence because if users experience fraudulent transactions or repeated false flags, their confidence in the platform drops. The AI agent helps maintain that trust by improving both protection and the overall experience.

Related AI Services

We’ve got everything you need.