Insurance Software & Services

Insurance ERP Software

Tell us about your project.

"*" indicates required fields

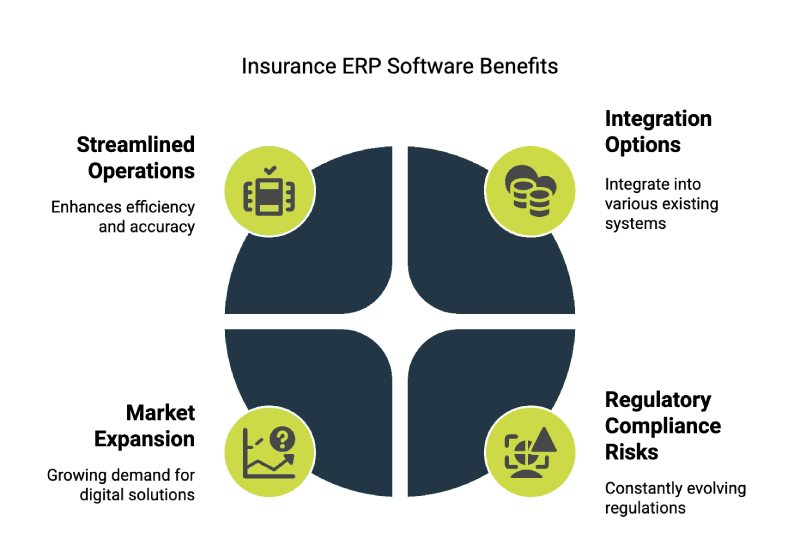

At Orases, our ERP solutions provide unparalleled business value for insurance companies.

Why Choose Orases?Enhanced customer service personalization is achieved through immediate access to reliable customer data, enabling a customer-centric experience and optimizing sales funnels by automating marketing activities. The consolidated data ensures secure access to consistent and reliable information from anywhere, reducing manual effort and eliminating human errors associated with repetitive data entries and manipulations, aiding in regulatory compliance and reducing operational costs.

Our insurance ERP solutions offer a 360-degree view of the company, improving synergy between departments and automating time-consuming activities, aiding informed decision-making, enabling advanced analytics initiatives, and consequently boosting business growth and profitability.

Custom Insurance Software We Develop

Engaging solutions that are proven to work.

Orases has developed a wide range of custom insurance software solutions across a multitude of industries over the years. Here is what we offer our business clients, regardless of the size or industry they operate in:

Insurance CRM Software

Improve your insurance business with Orases’ CRM software. Designed for the insurance industry, it streamlines operations, enhances customer relations, and boosts sales efficiency. Automate tasks and improve data management for better productivity.

Insurance Mobile Applications

Orases leads with innovative mobile insurance solutions, optimizing operations and enhancing customer interaction. Our apps prioritize user experience, analytics, AI integration, scalability, security, and customization, ensuring client satisfaction and industry success.

Insurance Quoting Software

Streamline your insurance quoting with Orases’ software, designed to deliver quick, accurate quotes for various insurance types. Enhance customer experience, build trust, and boost efficiency with features like policy configuration, multi-line quoting, and e-signatures.

Insurance Workflow Automation Software

Our technology streamlines operations and ensures compliance. Key features include process design, task assignment, document management, decision automation, role-based access, and audit trails.

Insurance Claims Management Software

Upgrade your insurance operations with Orases’ innovative claims management software. Designed to enhance customer satisfaction, our solutions automate tasks, reduce manual errors, and offer real-time claims visibility.

Insurance Policy Administration Systems

Orases pioneers advanced Insurance Policy Administration Systems, modernizing operations, enhancing customer experience, and providing innovation. Our tailored solutions optimize efficiency, diversify products, foster innovation, and elevate customer experiences.

Insurance Policy Management Software

Orases significantly improves insurance management with user-friendly software. Boost efficiency, enhance customer service, ensure compliance, and streamline operations.

Notable Features & Functionalities Insurance ERP Software Offers

What Orases ERP software can provide for you.

With our innovative solutions, insurance companies can manage and analyze their business operations and customer interactions more effectively, leveraging real-time data and insights to make informed decisions and enhance customer experiences.

Claims Management Software Integration

Insurance ERP software and claims management software integrations streamline claims processing, reduces manual data entry, enhances data accuracy, and improves overall efficiency. This integration ensures insurers can effectively manage claims from initiation to settlement while maintaining compliance with industry regulations.

Policy Management Software Integration

The integration of insurance ERP software with policy management software streamlines policy-related operations, minimizes manual data input, elevates data precision, and bolsters overall efficiency. This synergy empowers insurers to adeptly oversee policies, from inception to renewal, all while upholding compliance with industry regulations.

CRM Software Integration

The integration between insurance ERP software and CRM software elevates customer engagement, simplifies policy issuance and servicing, enhances cross-selling possibilities, and ultimately results in increased customer satisfaction and retention. Insurers are able to deliver a seamless and personalized experience to policyholders while optimizing their internal processes.

Quoting Software Integration

The integration between insurance ERP software and insurance quoting software enhances operational efficiency, reduces manual data entry, ensures data accuracy, and provides a holistic view of customer interactions and policies. It streamlines processes from quote to policy issuance and beyond, enabling insurance companies to provide better service and make informed decisions.

Workflow Automation Software Integration

Integrating insurance ERP software with insurance quoting software amplifies operational efficiency, diminishes manual data input, guarantees data precision, and offers a comprehensive perspective on customer interactions and policies. This integration streamlines workflows from generating quotes to policy issuance and beyond, enabling the ability to deliver superior service.

Underwriting

Our insurance ERP software ensures secure and fast access to relevant information for authorized users, automating user account management to comply with regulatory requirements and avoid information leakage.

Policy Management

Our software centralizes all policy-related information, simplifying management of the entire insurance policy lifecycle. It aids in quote management, policy storage, sharing, and distribution, and ensures policy tracking, reporting, and auditing under secure access control management.

Task Management

Automating task management activities with our insurance ERP solution aids in the enhancement of workflows, collaborations, and employee productivity. The software plans, schedules, reviews, assigns tasks and subtasks, and provides visualizations and alerts for completed tasks, overdue tasks, and to-do lists.

User Management

Custom software can streamline complex workflows and processes, improving productivity and reducing errors.

Insurance ERP Software Development Costs

A frame of reference when planning for your organization’s ERP software project.

Pricing for custom software development can vary greatly, depending on functionality/feature requests, technology stack requirements, and expected completion timeline.

$50,000 – $200,000

Developing smaller general software solutions with some complex features.

$500,000 – $1,500,000

Developing specialized software programs that can be designed for customer use.

$2,000,000+

Developing massive software projects designed fully automate large business operations.

Mobile Insurance ERP Capabilities

Empower your insurance operations with comprehensive mobile solutions that keep agents, underwriters, and customers connected and productive.

Agent Mobile Access

Complete insurance operations from any device, including policy creation, claims processing, and customer management. Features secure document access, real-time updates, and offline capabilities for field agents managing client interactions away from the office.

Customer Self-Service Portal

User-friendly mobile interface enabling policyholders to view coverage, submit claims, access documents, and make payments. Includes push notifications for policy updates, renewal reminders, and claim status changes, enhancing customer engagement and satisfaction.

Field Operations Support

Mobile-optimized tools for risk assessment, property inspection, and claims adjustment. Features include photo/video documentation, electronic signatures, GPS integration, and immediate synchronization with the core ERP system for real-time updates.

The Orases Process

How we work, from start to finish.

Our Insurance ERP software development team has years of experience designing and developing unique & innovative custom software using a streamlined, repeatable process.

Idea

This involves documenting key business processes and eliciting needs and concerns from stakeholders. Additionally, risks associated with introducing new software are evaluated, and mitigation measures are planned. For commercial software products, this phase also includes conducting competition analysis, understanding the target audience’s needs, defining product differentiation, and addressing obstacles to market entry, such as regulatory barriers.

Define Goals

Defining goals involves composing a comprehensive list of requirements and expectations, ensuring alignment between stakeholders and the development team. By starting with a precise definition of the project’s specific requirements and scope, clarity and focus are ensured, laying a solid foundation for the development process to follow.

UX/UI Design

UX/UI design will determine the software’s appearance at the user level, defining app architecture, and integrating existing enterprise systems for cost-effectiveness and reliability. Additionally, UX research is conducted to outline user personas and scenarios, followed by the creation of wireframes and clickable prototypes to visualize user interactions.

Development

Our development team begins working on the essential components of the software. This involves continuous delivery of new software parts, with ongoing analysis of emerging needs and release planning. Mockups are delivered and reviewed to ensure alignment with requirements before developers proceed with developing, testing, and migrating approved software parts to staging and production environments for deployment.

Testing

Orases will conduct thorough verification of functionality and performance, including performance monitoring and utilizing analytics tools for ongoing evaluation. Feedback is gathered from project sponsors and users on the results of the release, and the outcomes are reviewed to approve the scope of the next release. Continuous improvement is prioritized through iterative testing and refinement based on insights gained from monitoring tools.

Deployment

Deployment involves pushing the finalized product to the live server and conducting user testing to ensure it meets stakeholder expectations. Additionally, software monitoring processes are established to track performance and address any issues that may arise post-deployment.

Training & Support

This step includes conducting project evaluations and performing knowledge transfer sessions to your in-house IT team or other vendors involved. Comprehensive training and documentation are offered to users, empowering them to utilize the software effectively. Finally, a final report is provided, and confirmation for project closure is requested to conclude the development cycle.

Awards & Recognitions

Proof our Insurance ERP software continues to excel.

Industries We Build ERP Software For

Software built to address specific needs of organizations everywhere.

We tailor fit software to address the specific needs, pain points, and processes for the following industries.

Our Insurance ERP Software Speaks For Itself

But so do our clients.

Logan Gerber – Marketing Director at NFL Foundation

“Orases successfully built efficiencies into our prototype and delivered a high-quality platform.”

Matt Owings – President at Next Day Dumpsters

“They’re honorable, reputable, and easy to work with. They genuinely care about the outcome and want to do a good job.”

Donald J. Roy, Jr., CPA – Executive Vice President at American Kidney Fund

“Orases built a platform that’s boosted productivity by about 30%…”

Torey Carter-Conneen – Chief Operating Officer at American Immigration Lawyers Association

“Not only do they want to succeed, they strive to produce functionally and visually unique software.”

Frequently Asked Questions

Answers to the questions that’s been on everyone’s mind.

Can Insurance ERP Software Integrate With Other Systems?

Yes, insurance ERP software is designed to integrate with various third-party systems such as CRM (Customer Relationship Management) software, claims management software, document management systems, and financial systems. This integration ensures seamless data flow and enhances overall operational efficiency.

How Does The Software Handle Regulatory Compliance?

Insurance ERP software includes features to manage regulatory compliance, such as automated compliance checks, audit trails, and reporting capabilities. It helps insurance companies stay compliant with industry regulations and standards.

What Kind Of Analytics & Reporting Capabilities Does The Software Offer?

The software typically offers advanced analytics and reporting tools that provide insights into key performance indicators (KPIs) such as policy profitability, claims processing efficiency, financial performance, customer retention rates, and more. These analytics help insurance companies make data-driven decisions and optimize business processes.

How Does The Software Support Collaboration Across Departments?

Insurance ERP software facilitates collaboration by providing a unified platform for departments such as underwriting, claims, finance, and compliance. It enables seamless communication, data sharing, and workflow management, fostering cross-functional collaboration and efficiency.

Featured Insights

Take a deeper dive into the world of possibilities insurance ERP software offers.

Using Custom Insurance ERP Software For Process Optimization

At the core of custom insurance ERP software exists a deep understanding of the challenges and opportunities within the insurance industry.

Custom ERP Implementation in Insurance: Best Practices & Benefits

In the insurance industry, adopting custom insurance ERP software is imperative for tackling specific challenges & reaping benefits.

Related Services & Solutions

We’ve got everything you need.